Many wealthy investors are putting their fortunes into nonfinancial "treasure assets," such as collectible rare coins, in an attempt to diversify their portfolios (Nia Hamm, 'Flush investors take shine to rare coins' CNBC, 19 Feb 2014)

Many wealthy investors are putting their fortunes into nonfinancial "treasure assets," such as collectible rare coins, in an attempt to diversify their portfolios (Nia Hamm, 'Flush investors take shine to rare coins' CNBC, 19 Feb 2014)

"In the environment that exists right now, where the Dow is very high … most of the people buying rare coins … are people who are taking profits as a result of a semibull market … and want to reinvest some of that money into nondollar-based-type investments," said Terry Hanlon, president of the Professional Numismatists Guild. While the wealthy have always acquired art, antiques and other such valuables, experts believe that many of today's treasure seekers figure they're not only getting a beautiful object with their purchase but a savvy investment as well. "We've been seeing many new buyers entering the rare-coin market in recent years," said Greg Rohan, president of Heritage Auctions, which claims to be the world's largest collectibles auctioneer. "Many have collected fine art and invested in precious metals but now also are diversifying their portfolios with rare coins because they can appreciate their beauty and history, while the coins appreciate in value over the long term."

In 2012 the world's millionaires devoted an average of 9.6 percent of their fortunes to nonfinancial assets, such as collectibles, according to a survey by Barclays Wealth and Investment Management and Ledbury Research.The poll, of 2,000 people with investable assets of $1.5 million or more, also found that the proportion of wealthy individuals who own treasure assets has increased over the past five years. Coin collections, specifically, are up about 2 percent, and collectable rare coins are making their owners big money. About a decade ago, a six- or seven-figure price tag was an eyebrow-raiser. Today, not so much.

"The 'Mona Lisas' and Gauguins of numismatics are just exploding in price, as records are being broken virtually every time they come up for sale at auction," said Jeffrey Bernberg, past president of the Professional Numismatists Guild, in a news release. In fact, rare coins soared 248 percent in value over the past 10 years, according to the Luxury Investments Index, found in the Knight Frank 2013 Wealth Report. <This certainly puts a somewhat different perspective than that proposed by the supporters of no-questions-asked ancient coin purchase who say they are only doing it to "study" them ("only intrestid in the 'istry"

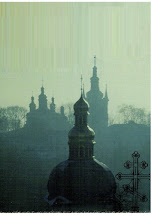

Vignette: Buying coins for investment but asking no questions about origins, not a good idea (Cabinet W deka).

3 comments:

Interesting read and thanks for highlighting it.

I've passed along your email relating to Poland to Arthur Houghton. Peter Tompa

" I've passed along your email relating to Poland to Arthur Houghton"

But you also posted it as a comment on your blog, right? So are you saying that Arthur Houghton only uses your blog when he's posting insulting comments about me?

Post a Comment